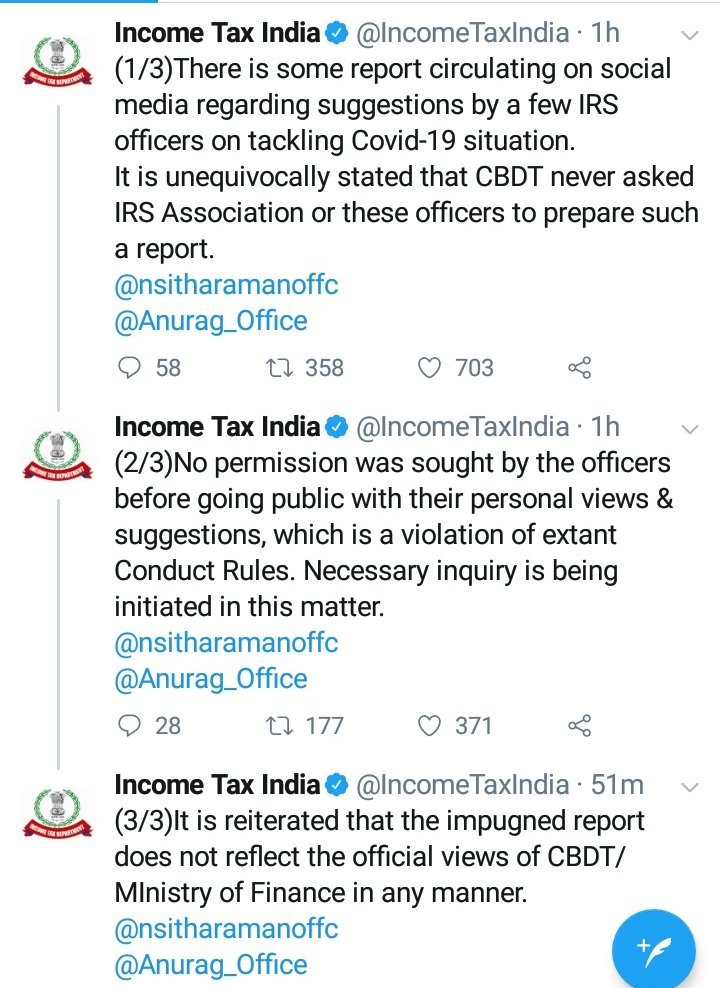

Yesterday Twitter was abuzz with suggestions shared by 50 IRS Officers suggestions. However, it appears that this is done in personal capacity by their Association. Everything has a purpose and the writer thinks no matter how good or bad the suggestions are, the matter should be allowed to rest as the intentions were good. The good part is IRS Association and GOI has lot of learning from this saga. Increasing revenue, offering relief, making long and short term plans for supoorting MSME and other sectors is no child play. Looking at businessmen as citizen who has amassed wealth is not a good sign.

#Covid19 has not shown it’s true colors yet. What we are seeing is tip of iceberg. Yes, lockdown and loss of life is the first impact. As we move ahead we would have multiple challenges, this includes cost of treatment, the way we travel in public vehicles like bus and trains, getting two square meals for the family, EMI’s after moratorium period is over. The list is long. Some serious problems are identified and some will emerge over a period of time.

Most citizens in #Covid19 impacted countries have seen force majeure. Be it flood, drought, cyclone or a tsunami. The attitude was of having sympathy for the victims, doing charity and prayers. This is the first time that a man made havoc is left loose. #CCPVirus danger is right in front of world community, just a few inches away. A citizen is safe yet not sure how his / her health would be two weeks down the line.

Citizens below poverty line are government responsibility and biggest vote bank. Hence, most political parties would like to take care of them by default. BJP has mastered the art of standing like a shadow for them in the most transparent and creative way. This time around is no diferent. Only ones who are being still taken care in some states are migrant labour.

Missing Voice of Support – Influential citizens have to hardly bother about month to month expense. It is the middle class that runs his / her life on EMI. They are either dependent on salary or some small business for which they have three fourth of their funds stuck in billing. At times they run their business on friendly borrowing as well.

Middle class is always treated as a punching bag. Right from the first budget of NaMo government to date there have been umpteen occasions when our very own RWs have gone ahead and tried to show them their place. Yes there are lot of benefits given but not as per the expectations of the deserving middle class. Some over enthusiastic RWs have gone to extent of showing some working on .xls even to prove their points. These savings are as good as mileage given for one litre of petrol by bike/car company. The numbers given are in ideal condition. The savings too are in ideal conditions, far from traffic jam- far from real life challenge. For a change if one accepts that there have been some tangible benefits too then they have come after lot of hue and cry. They come when water level has crossed throat and approaching nose.

Right wingers need to grow up and understand there is life beyond them and their maids. Before they write silly tweets like:

- Did you see the crowd at the jewellery shop, wonder where the money is coming from now

- Did you see the jump in sale of two and four wheelers?

- Now that NaMo has announced ______ relief/benefits, where are those advocates of Middle Income group who were cursing Modi and his government.

Learned right wingers should understand that crowd at jeweller shop does not mean that middle class is enjoying life. A symbolic purchase of INR 250 worth of silver coin has no meaning. Out of crores of middle class population if a miniscule percentage buys a bike or a car that doesn’t mean Aal is Well.

This time around the scene is different. The government should know that every law abiding MSME citizen that was paying tax on time is not begging. They deserve government assistance. The intention of the government is good but it raises fear after reading the IRS document. The report may have not any value for government but it has given a very good understanding of IRS officers approach. Government needs to spend heavily on their induction program, training and cyclic refresher course. It misses out on creativity, it lacks full proof planning and execution. It is focussed on time tested approach that has only created mess and heart burns.

Probably the 50 IRS officers are not aware of a book given by Shri Amit Shah to BJP MP’ in Aug 2019. There is a chapter dedicated to Chankya where is says “KING should collect tax in the same manner as honey bees extract nectar from flowers without hurting them”. Learned IRS team approach looks like they intend to put wrong manure to the plant in their effort to help it grow and uproot the plant while taking the nectar.

What need to be done is technology based assistance. The moment MSME is expected to meet bankers or any govenment officer, vicious circle will start.

For ease of understanding and planning the government needs to consider two income group:

INR 2 to 5 lacs and INR 6 to 10 lacs. Now we are in digital era. Government has access to all current and saving accounts, PAN, GST and MSME number.

Life has been bad in the last three years for most MSME. If that was not enough #Covid19 has done the worst to declining fortune of small business owners.

Though MSME guidelines say that the maximum credit period should be 90 days but in reality it doesn’t work. The fear of loosing client compels the vendor to continue and it strains the liquidity.

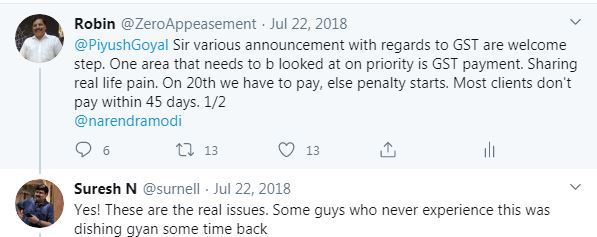

Problem and Solution 1 – Monthly payment of GST leads to problem. Either the vendor will have to loose the business or if he services the business then there is no money for paying GST before 20th of next month. This results in penalty on daily basis. If the payment is shifted to quarterly like the pre GST era, it shall make life simple for most MSME.

Problem and Solution 2 – On a routine basis citizens visit bank. The bankers hae their own challenges on a day to day basis and some instruction from Zonal Office that are never in writing. This leads to serious issues with customer in branch. Keeping in mind the stressful condition everyone is now in the next few months, a very basic flaw in banking has to be removed. Penalty and charges. It can’t be one way. This will also set the ball rolling for not only customer service but also customer delight.

RBI and finance ministry need to think of ways and means to encourage banks to give loans. The current system is to harass the loan seeker. Business is about taking risk so what are banks doing by having one sided clauses. Penal charges are one sided. When bank defaults the customer expected to meet some staff or write complaint. Reality is most of the time nothing happens on the spot. Even if someone has patience of going through Ombudsman then too to cross various level before reaching the highest it takes couple of months. A person can finish Temple Run faster but not his/her redressal.

In 2017 SBI collected INR 1771/- as penalty for not maintaing minimum balance. Interstingly, this amount was more than their net profit of INR 1582 crore. RBI and Finance Ministry should think about automating services based on Citizen Charter and fix instant penalty on the banks as well. There is fixed turn around time for transactional banking. What happens if the service is not given as per protocol. Not even an apology. Digital India and Core banking should make processes where the penalties are two way and instant credit is given in customer account. For other activites like processing a loan application, survey, returning original documents, etc too there should be a fixed TAT. If not met then customer should get credit. Writer can show enough proof of harassment. A responsible banker in the branch will ease a lot of burden of the government. This is the first step. Direct transfer to account of beneficiaries is already a proof of customer and citizen delight.

Secondly, time has come to relook CIBIL ratings that treats a law abiding tax payer as culprit. What needs to be done is few changes in loan disbursement at least for the next three years for MSME vendors.

Current pattern of CIBIL score of 750 and above to approve loan needs to be changed. The rating should start from 500 or 600 score. In the last three years lot of Pvt Ltd businesses have changed their status to Propietor or partnership or some have closed down.

The government needs to check past track record of these MSME. Were they paying their VAT, ST TDS and GST? If they have a good track record of paying their business tax on time, then they should be rewarded by relaxing CIBIL score now. For this purpose the approval based on CIBIL ratings should be lined to Tax payed based system. Dreaded criminals are given relief for good behaviour in jail. What is the purpose? To allow them to start a new life of dignity.

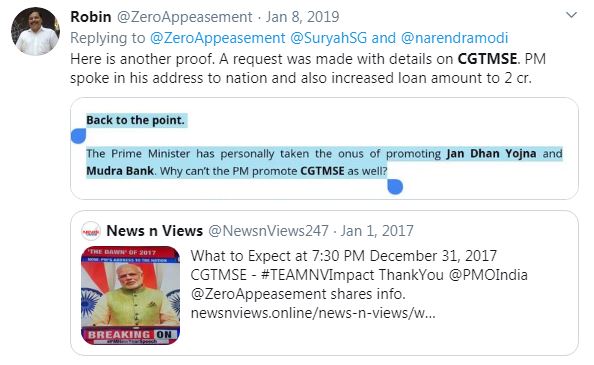

Criteria – Any MSME who has not done business turnover of five lacs in last 15 months but has a track record of paying taxes on time in previous 3 to 5 years and minimum turnover of 30 lacs plus YOY (irrespective in current or any entity that he/she was running earlier as Pvt Ltd / LLP / Partnership) should be eligible for Collateral free Credit Guarantee Fund up to INR 10 lacs. This amount is good enough for meeting day to day operating expense and getting back to work.

Process – This should be system generated pre approved loan. The government has various MIS at disposal. Just the way auto email and SMS are generated for tax defaulters, e mail and SMS should be sent to all eligible MSME to take benefit of the same by way of online process. There should be no involvement of the bank. Bankers are not interested in Collateral Free Credit Guarantee Funds. In current scenario of NPAs they would just give excuse and will take months for even saying no to the applicant. Once a email is generated the banker will have no reason to say no or harass the applicant.

Solution 3 – Another area the government needs to look at is revising tax slab. Revised tax slab can start from INR 10 lacs onwards. This will give additional cash in hand and come as big motivation.

Solution 4 – MSME who have not done INR 5 lacs of billing in the last 15 months should be given a family health insurance and option of converting their children school and college fee into default education loan if they wish. The moratorium period can be one year to 15 months with reasonable interest rate and tenure.

Solution 5 – Issue temporary BPL card to such MSME for a period of two years. Some don’t have money to buy ration. For how long NGO and police will help. A temporary BPL card based on their last 15 months GST returns can be used as due deligince criteria and online BPL card on lines of Aadhar can be issued.

Raising Funds and Cost Cutting

(1) Uniform of cental government employees can be auctioned. The cost of uniform is substantial. Highest bidder will have the option of making money in branding. Limitation and criteria can be set by government. This will create employment and reduce burden on government. Same can be done by state government in consultation with central government.

(2) Unusual mileage of 30 % while in service and even in pension to railway drivers, motorman and related functions. This needs to be withdrawn and challenged if required. In the past threat of mass strike has compelled government to ignore but difficult time needs not only tuff measures but also removing past mistakes.

(3) #GiveUpBenefits A thought shared by the writer of this article last year. This year a deduction of 30 % salary is announced for some fixed time period.

#GiveUpBenefits

— Robin (@ZeroAppeasement) June 26, 2019

Requesting our @PMOIndia to start a campaign for our financially well off law makers to #GiveUpBenefits

Ordinary citizens have done their bit, time super rich do the same.

Thanks,

https://t.co/VRK5tWcquS

Current Lok Sabha has 83% crorepati MP. Average asset per MP is close to INR 16 crore. 32 MP have more than 50 crore worth of asset. (Source:

Association for Democratic Reforms). While IRS officers have in right spirit recommended to give up some more benefits, GOI should seriously think of fixing expenditure limit on SUPER RICH politicians. The current circumstances demand there should be no personal benefits for law makers who are SUPER RICH. Slab needs to be fixed for each expense head.

Secondly, the Super Rich law makers can give up on their pensions. Time to lead by example.

(4) A long pending announcment of PM to ask Hon Supreme Court of India to take up corruption cases of MP needs to be implemented on war footing basis. The central and state government also need to check MIS of all land deals done with politicians. Name of politician, Market rate of the land and selling price. Purpose of the land deal. Status between then and now. If the land is not used for the purpose that it was given then there is lot at stake and such deals need to be cancelled and money recovered.

(5) Lot can be picked up from this series done last year for railways.

#Solutions

— Robin (@ZeroAppeasement) September 23, 2019

11/n

ECC Bank or rly Bank ( CRECCS Ltd) is a unique and succesful cooperative bank model in Central and one more zone.

If rly expands either take over this bank or extends the services of this Coop Bank to all 16 zones there would b so much of revenuue at disposal.

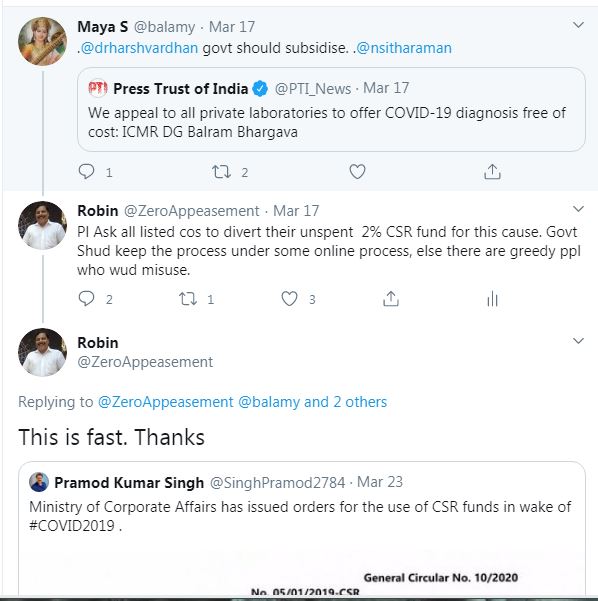

(6) CSR fund can be taken by central government and benefits can be passed on to the corporate. Apart from public listed companies government can make incentive plans for mid size comapnies not listed.

(7) North Eastern states needs to be enouraged to work with MSME in rest of India. There is a lot of small to big business opportunity even now post lockdown scenario. This will not only open up new markets within India but will also lead to employment opportunity. ( A customised plan / presentation can be given on request ).

(8) In these troubled times government should make all receivable of political parties taxable. This would set a good precedence in front of the nation. All political parties should come to a consensus on the percentage. If it is not done then the message would be very clear that there difference between preaching and practice.

(9) Implement Vendors Act 2014 – Needless to mention there is thousands of crores going in wrong hand at present. This ideally should be landing in government kitty. The only way it can be done is fixing deadline for forming Town Vending Committee with great transparency. Today a major percentage of the population is doing business on streets. Amount of drainage of revenue can be gauged from data given in this article by National Association of Street Vendors of India

Each minister is like a specialist doctor. The doctor can’t afford to treat the patient (MSME) in a cavelier way that he/she moves from general ward to ICU. The need of the hour is creativity in rolling out solution and not offering Band Aid treatement.

Picture Credit: Rishaba Lens, Screenshots from IRS Association twitter document and Twitter.